Explain the Key Differences Between Fixed and Variable Expenses

Fixed costs are incurred irrespective of any units produced. Additionally they can be divided into 2.

Fixed And Variable Expenses Sort Teks 4 10a Math Methods Personal Financial Literacy Math Projects

The Fixed cost is time-related ie.

. The key difference between product costs and period costs is that product costs are only incurred if products are acquired or produced and period costs are associated with the passage of time. Variable costs do change based on the number of things sold. Fixed costs do not change with the amount of the product that you produce and sell but variable costs do.

Explain the difference between a fixed expense and a variable expense include an example of each. Fixed costs are generally easier to plan manage and budget for than variable costs. Flexible budget on the other hand is adjustable as per the necessity of the business.

Thus a business that has no production or inventory purchasing activities will incur no product costs but. Managers with higher decision-making authority can control costs. Variable manufacturing overhead.

Difference Between Fixed vs Variable Fixed Cost. The fixed cost portion and the variable portion. Fixed costs are costs that do not vary depending on the number of units produced.

Fixed Cost is the cost which does not vary with the changes in the quantity of production units. A change in your fixed or variable costs affects your net income. Fixed costs remain constant regardless of the level of output by the company.

Variable Cost is the. Fixed and variable costs also have a friend in common. Flexible budget on the other hand is semi-variable.

For example the rental charges of a machine might include 500 per month plus 5 per hour of use. If you sell one glass of lemonade or one million the cost of the table stays the same. Fixed cost decreases with an increase in the number of units produced.

Fixed costs vs variable costs vs semi-variable costs. Sticking to it having a friend to keep accountable tracking expenses find a system that works adjustments actually creating a budget. One of the most popular methods is classification according to fixed costs and variable costs.

Fixed expense is consistentfixed same every. Variable costs change based on the amount of output produced. Fixed costs stay the same no matter how many sales you make while your total variable cost increases with sales volume.

Even if the company doesnt have any business activity they still have to cover the. Comparing Product Costs and Period Costs. The following point are substantial so far as the difference between fixed cost and variable cost in economics is concerned.

Variable costs are incurred as and when any units are produced. Fixed costs do not change based on the number of things sold. Variable cost per unit change in costchange in output.

Notice that the fixed manufacturing overhead cost has not been included in the unit. 5 4 1 4 14. A fixed budget is always fixed.

Variable cost incremental cost and stepped fixed cost are types of controllable costs. Fixed Budget operates in only one activity level but Flexible Budget can be operated on multiple levels of output. They consist of a significant portion of the total costs.

Variable cost increases with the increase. Fixed costs remain the same regardless of production output. What are some key components of succsessful budgeting.

The key difference between discretionary and committed fixed costs is that discretionary fixed costs are period specific. Fixed Expenses occur in predictable amounts and intervals. The difference between fixed and variable costs is that fixed costs do not change with activity volumes while variable costs are closely linked to activity volumes.

Variable cost remains the same irrespective of the number of units produced. Many costs are uncontrollable when decision-making authority is low. The 500 per month is a fixed cost and 5 per hour is a variable cost.

Fixed and variable costs are key terms in managerial accounting used in various forms of analysis of financial statements. A cost that has the characteristics of both variable and fixed cost is called mixed or semi-variable cost. Discretionary and committed fixed costs are two types of fixed costs often incurred by all types of companies.

The semi-variable costs can thus be separated into two terms. In most cases they occur on a monthly basis. Businesses use fixed costs for expenses that remain constant for a specific period such as rent or loan payments while variable costs are for expenses that change constantly such as taxes labor and operational expenses.

It also affects your companys breakeven point. Heres a look at the primary differences between fixed and variable costs. Fixed costs do not change with increasesdecreases in units of production volume while variable costs fluctuate with the volume of units of production.

Variable costs may include labor commissions and raw materials. Fixed expenses are your predictable regular costs which tend to be large like rent. Taken together fixed and variable costs are the total cost of keeping your business running and making sales.

Fixed cost vs variable cost is the difference in categorizing business costs as either static or fluctuating when there is a change in the activity and sales volume. Variable cost changes its value with the change in production. This difference is a key part of understanding the financial characteristics of a business.

As a result the semi-variable cost is also called the mixed cost and a semi-fixed cost. 5 4 1 10. 20000 5000.

Variable expenses can be estimated but not with certainty. Fixed Cost is an uncontrollable cost in nature. The unit product cost of the company is computed as follows.

One part of it is fixed and another change as per the activity level. Variable costs are the sugar the lemons and the water. Another example of mixed or semi-variable cost is electricity bill.

The fixed budget is static and doesnt change at all. Fixed Budget is static in nature while Flexible Budget is dynamic. That means it is the same for any activity level.

Semi-variable cost Fixed cost variable cost. Periodic Expenses are similar to fixed expenses but they occur much less frequently. Variable costs change in direct proportion to the changes in volume or business activity level.

Fixed Budget is based on the assumption whereas Flexible Budget is realistic. Fixed costs stay the same as more items are sold. When you operate a small business you have two types of costs - fixed costs and variable costs.

Fixed cost includes expenses that remain constant for a period of time irrespective of the level of outputs like rent salaries and loan payments while variable costs are expenses that change directly. Fixed cost is defined as a cost that does not change its value with any change Increase or Decrease in the. Does it change with the number of units.

35000 per year which computes to a 175 per unit cost 3500020000 annual units Under. Thus fixed costs are incurred over a period of time while variable costs are incurred as units are produced. Quarterly or annually Variable Expenses can be influenced by your financial behavior and decision-making.

Fixed Variable Expenses Interactive Notebook Activity Quick Check Teks 4 10a Interactive Notebook Activities Financial Literacy Worksheets Fraction Interactive Notebook

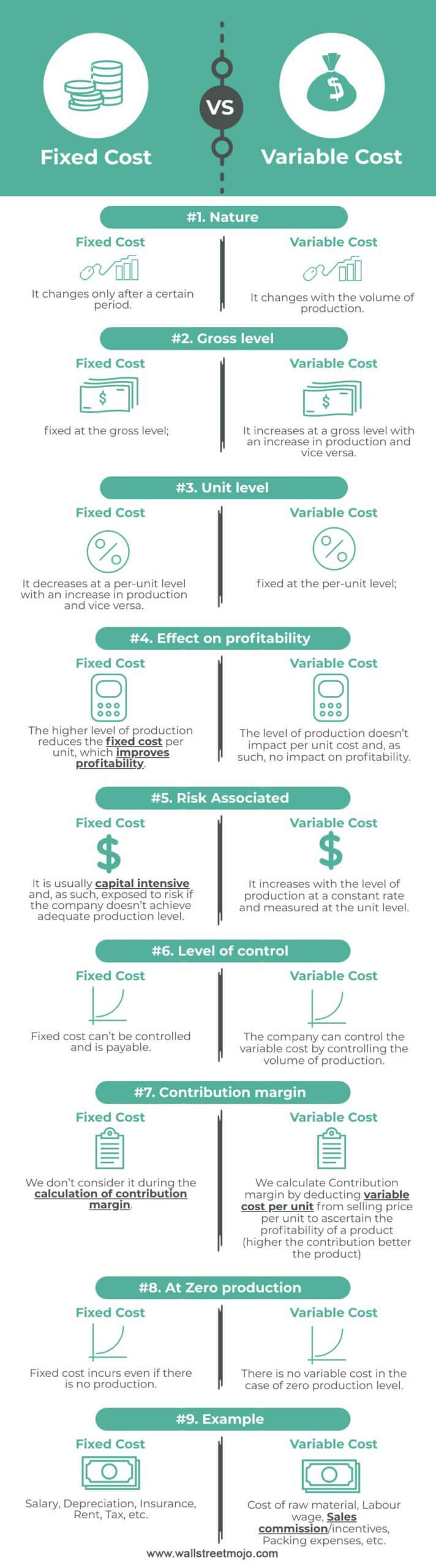

Fixed Cost Vs Variable Cost Top 9 Best Differences Infographics

Financial Literacy Fixed And Variable Expenses Staar Aligned Personal Financial Literacy Financial Literacy Economy Lessons

Fixed Cost Vs Variable Cost Top 9 Best Differences Infographics

Comments

Post a Comment